Company Tax Computation Format Malaysia

Resident company other than company described below 24.

Company tax computation format malaysia. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Where a company commenced operations. A company with paid up capital less than rm2 5 million is required to submit form cp204 within the first year.

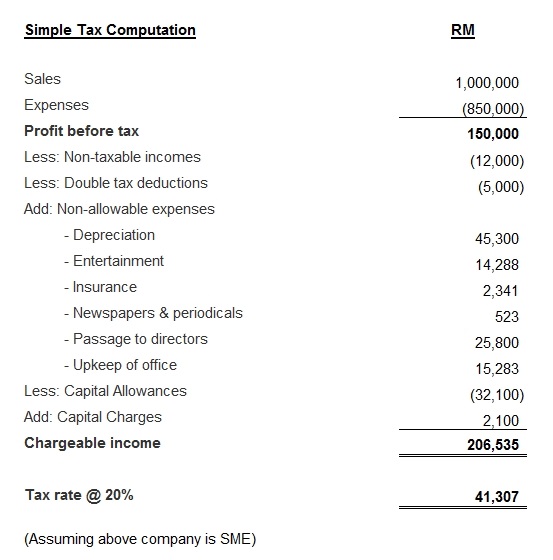

For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax. Chargeable income myr cit rate for year of assessment 2019 2020. With paid up capital of 2 5 million malaysian ringgit myr or less and gross income from business of not more than myr 50 million.

They need to apply for registration of a tax file. A company is required to furnish tax estimation form cp204 for the coming year to inland revenue board income tax department or lhdn within the first 3 months after the company has generated first sale. Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia.

This page is also available in. Income attributable to a labuan business. Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra.

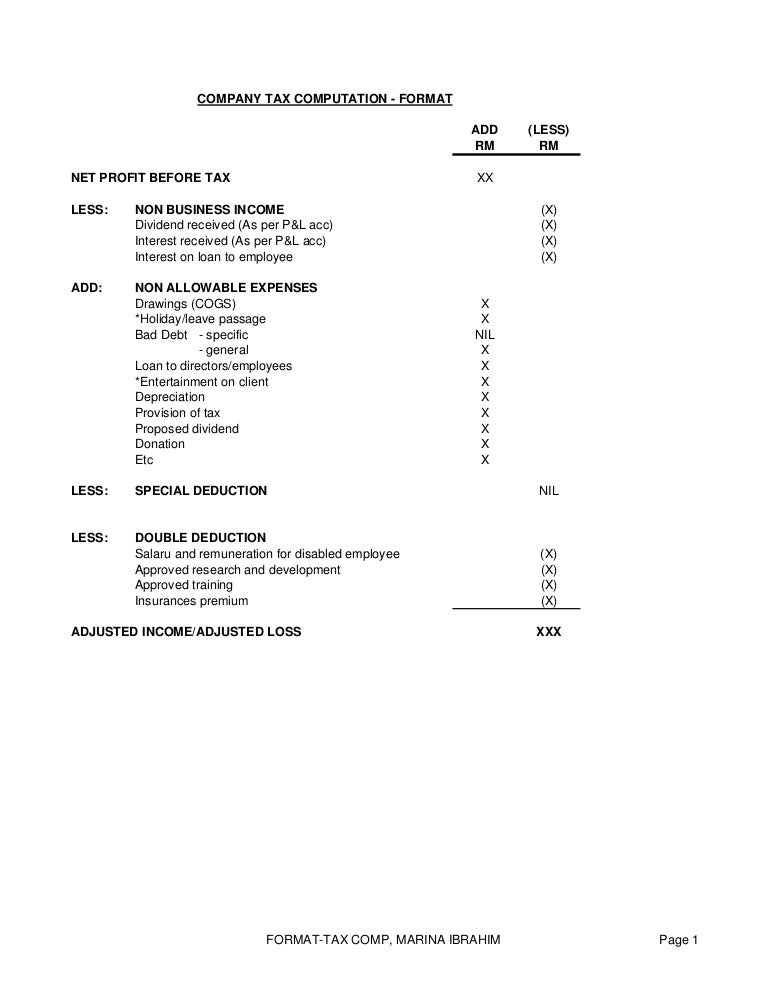

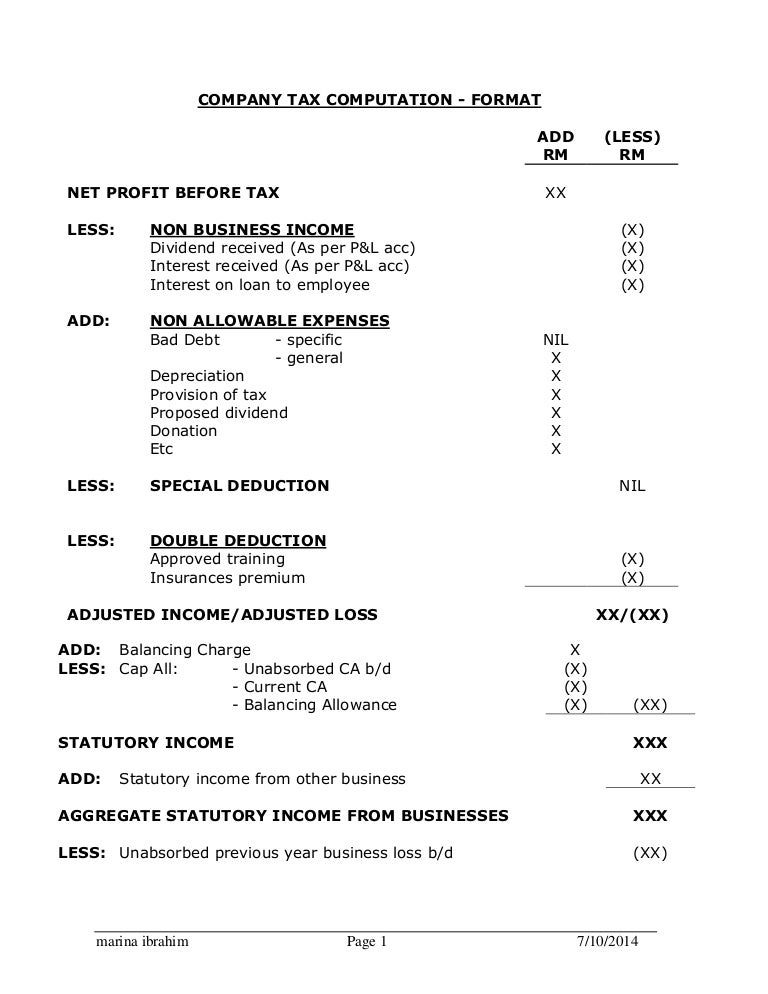

Income tax computation format for companies last updated at may 29 2018 by teachoo it is prepared taking into account different cases of expense disallowed learn more. Companies limited liability partnerships trust bodies and cooperative societies which are dormant and or have not commenced business are required to register and furnish form e with effect from year of assessment 2014.